Analytics ROI

What is ROI?

Return on Investment, commonly known as ROI, is a crucial financial metric used across industries to measure the efficiency and profitability of an investment. Whether you’re a seasoned investor, a small business owner, or a marketing professional, understanding ROI can help you make informed decisions and strategically allocate your resources.

What is Analytics ROI?

Analytics ROI also known as ROI Data is the Return On Investment on embedded analytics. It evaluates the financial gain or benefits derived from investing in analytics tools and processes against the costs involved. By measuring the effectiveness of analytics in driving business improvements, decision-making, and operational efficiencies, organizations can justify the expenditures on data analytics platforms, personnel, and technologies. Analytics ROI helps in assessing the value added by analytics to an organization’s bottom line, guiding strategic investments in data-driven decision-making capabilities.

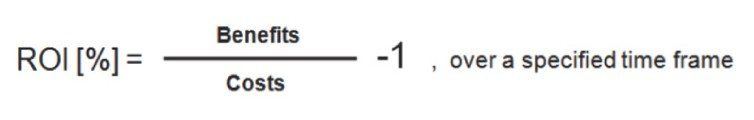

The components of the ROI formula are:

- Timeframe – Quantitative analysis is performed over a specified timeframe for a technology investment, typically three to five years.

- Benefits – The combination of the strategic benefits (e.g., revenue increase) and operational benefits (e.g., cost reduction).

- Costs – The investment to develop and maintain the solution.

- “-1” – The formula assures that a positive ROI is achieved only when benefits exceed the costs.

Calculating ROI

The formula for ROI is straightforward:

ROI=(Net Profit Cost of Investment)×100

This calculation helps determine the percentage return on a particular investment, enabling comparisons across different investment opportunities.

Calculating Analytics ROI

To calculate analytics ROI, use the following formula:

As an example, let’s say a commercial SaaS provider brings in $2 million in revenue per year. They expect that new embedded analytics functionality can drive a 10 percent increase in sales (to keep this simple, we’ll ignore annual compounding). Over three years, that comes out to $600,000 in added revenue. Because the self-service functionality is expected to free up half the time of a developer (and based on a $100,000 internal cost per year per developer), you also have a $50,000 per year increase in developer efficiency, so the total benefit is $750,000 over three years.

The costs are expected to be $50,000 per year in software plus $25,000 in expert technical services. If a developer dedicates one quarter of their time to this project, your developer costs are $25,000 per year. That makes the total cost $250,000 over three years. The formula looks like this: ($750k / $250k) = 3, so the ROI is 200 percent.

As a second example, consider an internal manufacturing application that helps process $2 million worth of product a year. Embedded analytics helps to streamline the process, reduce waste, and improve yield, all to the tune of 10 percent per year of total production. This results in $600,000 in savings over three years. And just like the first example, with $600,000 in revenue – if we make the same assumptions for additional benefits and for cost – we also end up with 200 percent ROI.

Importance of ROI

ROI’s significance lies in its versatility and simplicity. It serves as a fundamental indicator of an investment’s potential return, helping stakeholders understand whether an investment is likely to be profitable. Furthermore, it aids in performance evaluation, budgeting, and forecasting, making it an indispensable tool for financial analysis.

Applications of ROI

- Investment Analysis: Investors use ROI to compare the efficiency of multiple investment opportunities.

- Business Decisions: Businesses apply ROI calculations to assess the profitability of capital expenditures, project proposals, and marketing campaigns.

- Personal Finance: Individuals can use ROI to evaluate real estate investments, stock market investments, or the financial return on educational endeavors.

Limitations of ROI

While ROI is widely used, it’s not without its limitations. It does not account for the time value of money and can oversimplify complex investment scenarios. Therefore, it should be used in conjunction with other financial metrics for a comprehensive analysis.

Conclusion

ROI is an essential metric for anyone involved in making investment decisions. By effectively calculating and interpreting ROI, individuals and businesses can enhance their financial strategies, optimize their investments, and achieve their financial goals.